Cross-Chain Interoperability Protocol (CCIP) | Chainlink

Universal interoperability across DeFi and institutions

With built-in compliance and privacy capabilities, along with unmatched security, CCIP enables digital asset transfers across blockchains with confidence.

Expand access to 70+ blockchains

Unlock global market access

Reach a larger userbase by seamlessly connecting digital assets and applications across multiple blockchains through a single, secure standard.

Maximize asset utility and unify liquidity

Enable assets to move and be used across ecosystems, unlocking deeper liquidity and new use cases like lending, staking, and settlement.

Leverage battle-tested security

Build with battle-tested security powered by Chainlink oracle networks, proven infrastructure with a track record of securing tens of billions of dollars and enabling tens of trillions in onchain transaction value.

Build with institution-ready interoperability

Expand asset distribution & liquidity

Wider investor reach

Reach more investors by seamlessly offering tokenized assets across multiple blockchains through a single, secure integration.

Increased utility & liquidity

Enable assets to move and be used across ecosystems, unlocking deeper liquidity and new use cases like lending, staking, and settlement.

Golden record management

Unified Asset Oversight: Maintain a real-time, consistent view of asset data—like NAV and holdings—even as those assets move across chains.

Enhance digital asset operations

Multi-Chain Asset Support

List, trade, and manage digital assets across multiple blockchains without the need for chain-specific infrastructure.

Efficient cross-chain settlement

Accelerate settlement between chains while minimizing counterparty and operational risk.

Unified infrastructure integration

Connect to a single, secure interoperability layer to simplify operations across custodians, venues, and blockchain networks.

Enhance multi-chain custody & transfers

Enhanced custody offering

Support secure multi-chain asset custody and transfers through a single integration—reducing reliance on chain-specific solutions and investments.

Reduced operational risk

Mitigate cross-chain transaction risk with Chainlink’s secure messaging layer, ensuring integrity, finality, and traceability.

Simplified asset servicing

Gain a unified view of cross-chain asset positions and activity to streamline NAV reporting, reconciliations, and corporate actions.

Secure CBDC interoperability & cross-border collaboration

CBDC interoperability

Connect CBDCs with domestic/international digital currency systems.

Secure cross-border payments

Utilize CCIP for efficient, secure cross-border value transfer.

Control & security

Ensure secure communication/asset movement across blockchains.

Modular security & compliance capabilities

Privacy-protected interoperability

Transfer data and value across blockchains with built-in privacy that keeps sensitive information confidential, as seen in ANZ's use case from Project Guardian.

Compliance-enabled

Leverage a customizable rules engine to define, execute, enforce, and monitor your own compliance policies onchain, both at the asset and transaction level.

Battle-tested security

Leverage Chainlink’s modular security framework, powered by decentralized oracle networks (DONs), Token Developer Attestation, and multi-layered risk management, to protect cross-chain transactions with the same proven infrastructure that enables trillions in onchain value.

Universal blockchain connectivity

Connect seamlessly across 60+ public and private blockchains through a single integration, enabling secure and compliant interoperability.

Adoption in action

See how leading financial organizations are leveraging Chainlink CCIP to connect assets, systems, and markets.

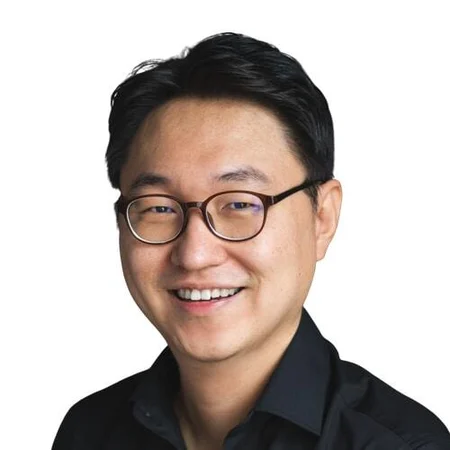

“By leveraging Chainlink CCIP for secure and compliant blockchain interoperability, this use case [Project Guardian] showcases the utility of tokenized financial assets within a regulated environment.”

Inmoo Hwang

Co-Founder and Group CFO, ADDX

“We look forward to exploring the privacy-preserving capabilities of Chainlink CCIP to support our customers with end-to-end private transactions.”

Richard Schroder

HEAD OF DIGITAL ASSET SERVICES, ANZ

“This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new onchain financial products and lower operational costs to investors”

Winston Quek

CEO, SBI Digital Markets

“Our work with UBS Asset Management and Chainlink... leverages the global Swift network to bridge digital assets with established systems.”

Jonathan Ehrenfeld Solé

Head of Strategy, Swift

Scale with security. Chainlink is certified by globally recognized standards bodies.

Build for every market in DeFi

Make your asset universally accessible

Connect your asset to an ever-growing network of public and private blockchains through a single integration, making it instantly composable across chains and easy for other applications to integrate and build on.

Integrate in minutes, upgrade seamlessly

Go cross-chain without redeploying tokens, migrating contracts, or splitting liquidity. With tools like Token Manager, getting started is fast and upgrades happen seamlessly without needing to change anything.

Build cross-chain with confidence on proven infrastructure

Equip your protocol or asset with the same decentralized security and always-on reliability that’s protected trillions in DeFi. Built on Chainlink’s battle-tested decentralized oracle networks (DONs), it removes single points of failure and delivers trusted cross-chain execution, so you can scale with confidence across chains and into capital markets.

Avoid fragmented liquidity

Operate natively across multiple chains while maintaining unified liquidity. Eliminate the complexity of bridging and unlock new growth without introducing trust assumptions or fragmented deployments.

Build with proven security

Trigger actions across chains with programmable token transfers and verifiable messages, all secured by Chainlink’s decentralized oracle networks. CCIP gives your protocol the power to scale reliably without compromising on execution integrity.

Ship features faster

Leverage CCIP’s modular architecture and developer tooling to rapidly deploy cross-chain functionality without building custom bridges, integrations, or relayers. Focus on protocol innovation, not interoperability infrastructure.

Connect instantly to a growing network of chains

Become interoperable with a growing network of 60+ public and private blockchains, making it easier for apps, assets, and users to move in and out of your ecosystem.

Enable secure cross-chain messaging and asset transfers

Provide native support for token transfers and cross-chain communication using CCIP’s battle-tested infrastructure. Eliminate the need for custom bridges while offering developers trusted interoperability out of the box.

Attract more builders

Lower the barrier for developers by offering CCIP as a built-in service for secure cross-chain interactions. Whether for token flows, governance, or application logic, CCIP makes your chain a seamless part of the multi-chain future.

“...with Chainlink CCIP’s unmatched cross-chain security, GHO enables new decentralized stablecoin applications, unlocking their potential for broader use and setting the stage for a new era of innovation.”

Stani Kulechov

Founder, Aave

“With Chainlink CCIP’s Programmable Token Transfers, Lido’s Direct Staking simplifies staking across Layer 2 networks, improving liquidity for wstETH and enhancing cross-chain interoperability.”

Jakov Buratović

Master of DeFi, Lido

“With Chainlink CCIP, Proof of Reserve, and Price Feeds, we will securely scale BTCFi and rebuild decentralized finance atop Bitcoin, unlocking a host of new financial products.”

Jacob Phillips

Co-Founder, Lombard Finance

“A secure BTCFi ecosystem needs robust and battle-tested infrastructure, which is why integrating Chainlink was an obvious choice.”

Ryan Chow

Solv Protocol Founder

Increase market access with CCIP

CCTs are cross‑chain native tokens powered by CCIP. This self‑serve standard lets developers onboard new or existing tokens in minutes with tools like Token Manager—all backed by Chainlink’s battle‑tested infrastructure.

Cross-Chain Tokens (CCT)

Self-serve and permissionless

Token developers can launch a new CCT or make an existing token a CCT in a self-serve manner within minutes. When creating CCTs, CCIP contracts verify token contract ownership onchain to avoid fragmentation and help token developers remain in control of their tokens. Developers also have access to a number of resources that make the CCT creation process and ongoing management seamless, including a Token Manager, CCIP Explorer, CCIP Directory, and accompanying documentation (both tutorials and scripts).

Developer control and flexibility

Token developers retain full ownership of their token contracts, CCIP token pools, and customized implementation logic. This autonomy eliminates the need for vendor lock-in, hard-coded logic, or external dependencies, allowing developers to customize functionality without compromising security.

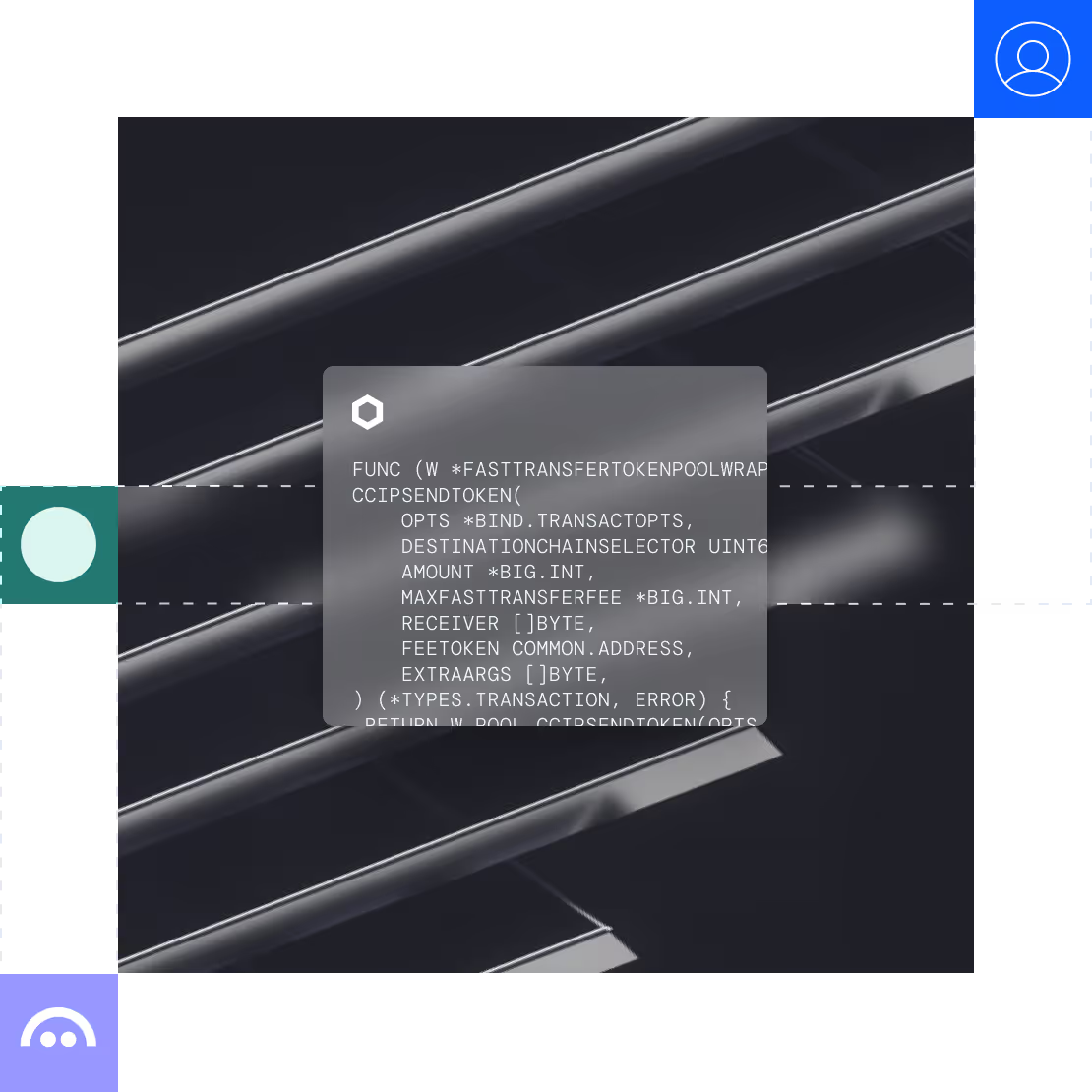

Programmable token transfers

CCIP supports cross-chain transfers with embedded instructions for actions on the destination chain. Through CCIP’s Programmable Token Transfers, complex workflows involving multiple chains can be executed as a single atomic cross-chain instruction.

Token developer attestation

Token developers can enhance the security of their CCTs by adding external verifiers. This feature enables developers to actively participate in the cross-chain verification process by attesting to token burn or lock events on source chains before CCIP mints or releases tokens on destination chains.

This is especially useful for stablecoins, wrapped assets, staking derivatives, and tokenized real-world assets (RWAs) to enable more robust security models and address compliance needs.

Defense-in-depth security

CCTs are secured by Chainlink CCIP, which is powered by the same battle-tested Decentralized Oracle Network (DON) infrastructure that has enabled trillions in onchain transaction value. Each CCIP transfer is validated by multiple DONs and is equipped with other modular risk management and policy compliance capabilities.

No reliance on liquidity pools

By utilizing burn-and-mint mechanisms, CCTs eliminate the need for liquidity pools. This simplifies cross-chain token operations and avoids common limitations associated with liquidity-based solutions.

Zero-slippage transfers

Pre-audited token pool contracts ensure that tokens sent on the source chain match the exact amount received on the destination chain, enabling seamless zero-slippage cross-chain transfers.

Access a global user-base

A hyper-secure bridging app built in association with the Chainlink Foundation, with support from Chainlink Labs.

A cross-chain protocol enabling seamless digital asset transfers across chains.

A cross-chain protocol enabling seamless digital asset transfers across chains.

Learn about CCIP

Explore technical documentation and expert insights to better understand how Chainlink CCIP powers cross-chain applications.